UAE Oil Market Trends: Production Growth, Diversification, and Sustainability in 2025

UAE Oil Market Trends: Production Growth, Diversification, and Sustainability in 2025

Abu Dhabi, UAE

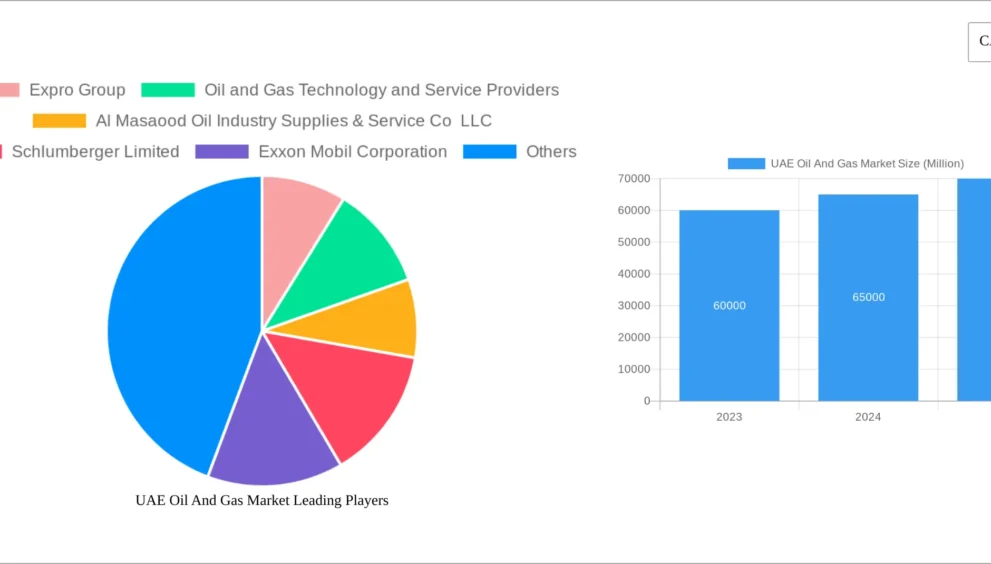

The United Arab Emirates (UAE) remains a pivotal player in global oil markets in 2025, balancing ambitious production increases with strategic diversification and sustainability initiatives. As a key OPEC+ member, the UAE is navigating a complex landscape of supply dynamics, geopolitical influences, and the global energy transition. Recent developments highlight the country’s efforts to strengthen its oil industry while positioning itself as a leader in low-carbon energy.

ADNOC Drives Production Capacity Expansion

The Abu Dhabi National Oil Company (ADNOC) is on track to achieve its target of 5 million barrels per day (b/d) of crude oil production capacity by 2027, with significant progress made in 2025. In the first half of the year, ADNOC boosted output by 200,000 b/d, reaching 4.85 million b/d, largely through enhanced drilling in the onshore Bu Hasa field and offshore Upper Zakum field. The company’s $150 billion investment plan through 2027 is focused on expanding upstream capacity and upgrading facilities to maintain efficiency. These efforts align with OPEC+’s strategy to gradually increase output, with the UAE contributing to the group’s 548,000 b/d supply hike since August 2025.

Oil Prices Face Downward Pressure

The UAE’s production growth comes amid a global oil surplus projected to reach 1.7 million b/d by early 2026, according to the International Energy Agency. Brent crude prices are expected to decline from $68 per barrel in August 2025 to around $50 per barrel in Q1 2026, driven by increased OPEC+ supply and softening demand in major markets like China. The UAE’s high-quality Murban crude, traded on the ICE Futures Abu Dhabi exchange, remains a benchmark for Asian markets, but price volatility is prompting ADNOC to optimize export strategies to maintain revenue stability.

LNG and Gas Exports Gain Momentum

The UAE is expanding its liquefied natural gas (LNG) and natural gas exports to meet rising global demand, particularly in Asia. ADNOC Gas is advancing the Ruwais LNG project, set to start exports in 2028, with a capacity of 9.6 million metric tons per annum. In 2025, the UAE’s natural gas production rose by 3%, driven by developments in the Ghasha ultra-sour gas field. This growth supports the country’s role as a reliable gas supplier, especially as Europe seeks alternatives to Russian LNG ahead of the EU’s planned re-export ban in March 2025.

Sustainability and Low-Carbon Investments

The UAE is aligning its oil and gas sector with global energy transition goals, with ADNOC leading investments in carbon capture, utilization, and storage (CCUS) and renewable energy. The Al Reyadah CCUS facility is capturing 2.3 million metric tons of CO2 annually, with plans to scale up to 5 million tons by 2030. ADNOC’s partnership with Masdar, the UAE’s clean energy company, is integrating solar and wind power into oil and gas operations, reducing emissions by 10% at select facilities in 2025. These efforts support the UAE’s Net Zero by 2050 strategy while maintaining its position as a global energy leader.

Petrochemical Sector Expansion

The UAE’s petrochemical industry is a growing contributor to oil demand, with ADNOC investing $10 billion in the Borouge 4 project to expand petrochemical production capacity by 1.4 million metric tons per year by 2026. This aligns with global trends, as petrochemicals are projected to account for 18–20% of oil demand by 2040. The UAE’s strategic location and access to low-cost feedstocks give it a competitive edge, though global supply chain disruptions and competition from Asian producers pose challenges.

Geopolitical and Market Dynamics

Geopolitical risks, including tensions in the Strait of Hormuz, where 21% of global petroleum liquids pass, remain a concern for the UAE’s oil exports. The country is diversifying trade partnerships, with China and India accounting for 60% of its crude exports in 2025. The UAE’s role in BRICS+, following its inclusion in 2024, strengthens its influence in shaping global energy policies. Additionally, ADNOC’s adoption of AI and digital twins has improved operational efficiency by 12%, helping mitigate market volatility.

Industry Resilience Amid Challenges

The UAE’s oil and gas sector is navigating market pressures through capital discipline and technological innovation. ADNOC reported a 15% increase in operational efficiency in 2024, driven by digitalization and predictive maintenance. While global industry layoffs have affected some markets, the UAE has maintained workforce stability, with ADNOC creating 2,000 new jobs in 2025 to support its expansion. Mergers and acquisitions are also on the rise, with ADNOC acquiring stakes in international assets to bolster its global footprint.

Outlook for 2025

The UAE’s oil market in 2025 is defined by robust production growth, strategic diversification, and a commitment to sustainability. As ADNOC advances its 5 million b/d target and invests in low-carbon technologies, the country is well-positioned to maintain its influence in global energy markets. However, navigating price volatility, geopolitical risks, and the energy transition will require continued adaptability and innovation.